содержание .. 1 2 3 4 ..

ЕВРАЗ. Годовой отчет за 2021 год - часть 3

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

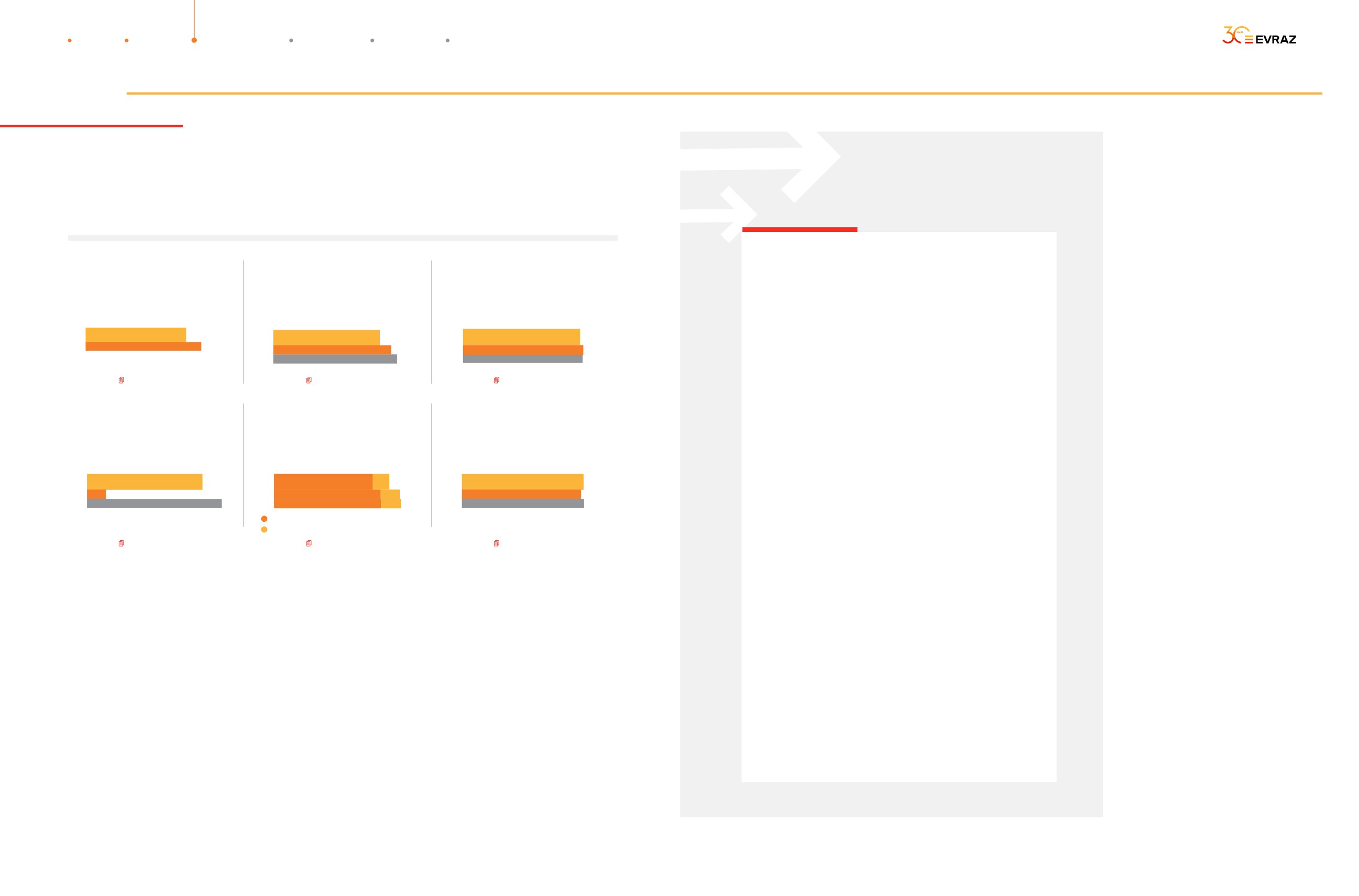

CAPEX AND KEY PROJECTS

FINANCING AND LIQUIDITY

During the reporting period, EVRAZ’ capital expenditures rose to US$920 million, compared with US$657 million in 2020, driven by higher

EVRAZ began 2021 with total debt

In the process of preparing for a potential

in 2021, all of which had high coupon rates,

development expenses. Capital expenditure projects during 2021, indicated in millions of US dollars, can be summarised as follows.

of US$4,983 million

demerger of its Coal assets, the Group

together with management’s efforts to reduce

obtained necessary creditor approvals,

total debt and refinance indebtedness

In January, the Group repaid at maturity

including a Eurobond consent solicitation

on favourable terms, led to the significant

Development Projects, US$ million

US$735 million in outstanding principal of its

from the majority of holders of its Eurobonds

reduction of interest expense compared

Eurobonds due in 2021. In June and August,

due in 2022, 2023 and 2024. It also took

with the previous year.

Steel segment

the Group completed several transactions

steps to rebalance its debt between the Steel

Tashtagol iron ore mine upgrade at EVRAZ ZSMK mining site

33

to repurchase, in aggregate, US$65 million

and Coal divisions and refinance certain

The higher EBITDA amid a strong market

The project aim is to increase the annual iron ore production of the Tashtagolsky deposit with a partial

in outstanding principal of its Eurobonds

outstanding loans.

recovery and lower net debt resulted

switch to sub-level caving using mobile equipment.

due in 2022 and later in October completed

in a significant reduction in the Group’s

Sobstvenno-Kachkanarsky deposit greenfield project

29

a make-whole call for the remaining

Raspadskaya received a US$200 million

major leverage metric, the ratio of net debt

The project aim is to maintain production of raw iron ore.

US$435 million in outstanding principal

long-term loan from Alfa Bank

to last twelve months (LTM) EBITDA, to 0.5

Rail and beam mill modernisation at EVRAZ NTMK

14

of these Eurobonds.

and a US$200 million long-term loan from

as at 31 December 2021, compared with 1.5

SberBank.

as at 31 December 2020.

The project aim is to increase production of beams and sheet piles.

In March, the Group repaid, at maturity,

Construction of Vanadium processing facility at EVRAZ Uzlovaya

13

RUB15,000 million (roughly US$201 million)

Steelmaking subsidiaries of the Group repaid

As at 31 December 2021, various bilateral

The strategic aims of the new unit are to increase cost efficiency in fully controlled and coordinated

in outstanding principal of its ruble-

a total of around US$619 million of their

facilities with a total outstanding principal

at all stages processing chain from slag to final product.

denominated bonds due in 2021.

outstanding bank debt of varying maturities

of around US$1,697 million contained financial

Transfer of direct coke oven gas for cleaning in capture shop no. 3 at EVRAZ NTMK

11

during 2021.

maintenance covenants tested at the level

The project aim is to decrease air emissions.

In March, to compensate for the reduction

of EVRAZ plc, including a maximum net

Reconstruction of pig-casting machines section for blast furnace at EVRAZ NTMK

9

in liquidity, EVRAZ drew US$750 million

As a result of these actions,

leverage and a minimum EBITDA interest

under the committed syndicated facility that

as well as scheduled repayments of bank

cover.

Technical re-equipment of the bottling section blast furnace machines.

it signed with a group of international banks

loans and leases in 2021, total debt fell

Construction of uncompressed gas recovery turbines for blast furnace no. 7 at EVRAZ NTMK

6

in early 2020.

by US$889 million to US$4,094 million

New debt facilities of Raspadskaya

The project aim is to increase own electricity generation.

as at 31 December 2021.

contain financial maintenance covenants

Steel, North America segment

In February, EVRAZ signed a new credit

tested on the consolidated financials

Long rail mill at EVRAZ Pueblo

146

facility with SberBank and borrowed

In 2021, EVRAZ paid three interim dividends

of Raspadskaya, including a maximum net

US$67 million of the available funds.

to its shareholders: US$437 million (US$0.30

leverage and a minimum EBITDA interest

The project aim is to replace the existing rail facility and meet the needs of customers for long rail products.

per share) in April, US$292 million (US$0.20

cover.

Electric arc furnace (EAF) repowering at EVRAZ Regina

7

In June, EVRAZ signed an amendment to its

per share) in June, and US$802 million

The project aim is to increase EVRAZ Regina’s prime coil and plate production and reduce electrode

existing US$100 million credit facility with ING

(US$0.55 per share) in September.

As at 31 December 2021, EVRAZ and its

consumption.

DiBa, extending its repayment schedule until

subsidiaries were in full compliance

Coal segment

2026 and increasing its size to US$150 million.

On 14 December 2021, EVRAZ announced

with the financial covenants.

Acquisition of equipment at Alardinskaya mine

17

In July, EVRAZ utilised an additional

an interim dividend to its shareholders

The project aim is to reduce the time required for transition from longwall to longwall and to increase

US$50 million. In October, the Group

of US$292 million (US$0.20 per share),

As at 31 December 2021, cash and cash

annual production volumes to 3.2mt.

agreed an amendment to this credit

payable in January 2022.

equivalents amounted to US$1,427 million,

facility implementing sustainability-linked

while short-term loans and the current

Acquisition of equipment at Raspadskaya-Koksovaya mine

12

provisions, namely a pricing mechanism

Net debt dropped by US$689 million

portion of long-term loans amounted

Equipment for open pit mining.

linked to the management score component

to US$2,667 million, compared

to US$101 million. Cash balances

Acquisition of equipment at Osinnikovskaya mine

11

of the Sustainalytics ESG rating.

with US$3,356 million as at 31 December 2020.

and committed credit facilities available

The project aim is to acquire equipment that fully complies with the mining and geological conditions

to the Group (US$623 million) comfortably

to provide the projected monthly longwall load.

In November, EVRAZ signed a new,

Interest expense accrued on loans, bonds

cover upcoming maturities.

Other development projects

95

committed US$350 million credit facility

and notes amounted to US$186 million during

MAINTENANCE CAPEX

517

with Intesa with an availability period of six

the period, compared with US$291 million

months from the signing date. The facility

in 2020. The repayment of the Eurobonds

TOTAL

920

remained unutilised as at 31 December 2021.

due in 2021 and 2022 and ruble bonds due

40

41

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

Sales volumes of Steel segment, thousand tonnes

REVIEW OF OPERATIONS BY SEGMENT

2021

2020

CHANGE, %

Steel products, external sales

11,597

12,197

(4.9)

(US$ MILLION)

STEEL

STEEL, NORTH

COAL

OTHER

Semi-finished products

5,541

6,039

(8.2)

AMERICA

Construction products

3,905

3,944

(1.0)

2021

2020

2021

2020

2021

2020

2021

2020

Railway products

1,192

1,299

(8.2)

Revenues

10,188

6,969

2,324

1,779

2,321

1,490

535

410

Flat-rolled products

245

267

(8.2)

EBITDA

3,609

1,930

321

(28)

1,292

400

19

15

Other steel products

714

647

10.4

EBITDA margin

35.4%

27.7%

13.8%

(1.6)%

55.7%

26.8%

3.6%

3.7%

Steel products, intersegment sales

29

67

(56.7)

CAPEX

468

401

216

92

228

154

8

10

TOTAL STEEL PRODUCTS

11,626

12,264

(5.2)

Vanadium products (tonnes of pure vanadium)

20,341

18,696

8.8

Vanadium in slag

7,053

6,129

15.1

Vanadium in alloys and chemicals

13,288

12,567

5.7

Steel segment

Iron ore products (pellets)

1,430

1,732

(17.4)

Sales review

Geographic breakdown of external steel product sales, US$ million

Steel segment revenues by product

2021

2020

CHANGE, %

2021

2020

Russia

4,263

2,962

43.9

US$ MILLION

% OF TOTAL

US$ MILLION

% OF TOTAL

CHANGE, %

Asia

2,627

2,200

19.4

SEGMENT

SEGMENT

REVENUES

REVENUES

CIS

682

490

39.2

Steel products, external sales

8,842

86.8

6,079

87.2

45.5

Europe

596

221

n/a

Semi-finished products1

3,779

37.1

2,479

35.6

52.4

Africa, Americas and rest of the world

674

206

n/a

Construction products2

3,177

31.2

2,013

28.9

57.8

TOTAL

8,842

6,079

45.5

Railway products3

1,083

10.6

1,099

15.8

(1.5)

Flat-rolled products4

237

2.3

146

2.1

62.3

In 2021, the Steel segment’s revenues

greater beam sales prices, as well as higher

Steel segment revenues from sales of

Other steel products5

566

5.6

342

4.9

65.5

climbed by 46.2% YoY to US$10,188 million,

sales prices for channels, primarily

iron ore products, including intersegment

Steel products, intersegment sales

28

0.3

37

0.5

(24.3)

compared with US$6,969 million in 2020. This

on the Russian market.

sales, surged by 60.3%, driven by an 77.7%

was the result of higher sales prices, primarily

jump in sales prices and a 17.4% decline in

Including sales to Steel, North

8

0.1

26

0.4

(69.2)

for semi-finished products and construction

Revenues from external sales of railway

sales volumes. The main decrease in sales

America

products, as well as greater vanadium product

products decreased because of reductions

volumes was caused by a shortage of iron

Iron ore products

234

2.3

146

2.1

60.3

volumes.

of 8.2% in sales volumes, which was partly

ore, unplanned equipment downtimes and

Vanadium products

515

5.1

349

5.0

47.6

offset by a 6.7% increase in sales prices.

logistics restrictions.

Other revenues

569

5.6

358

5.1

58.9

Revenues from external sales of semi-finished

The drop in sales volumes was caused

products rose by 52.4% YoY. This was driven

mostly by lower sales of rails amid reduced

During the reporting period, around 68.1%

TOTAL

10,188

100.0

6,969

100.0

46.2

by a 60.6% increase in average prices, which

demand in Russia and the CIS.

of EVRAZ’ iron ore consumed in steelmaking

was partly offset by an 8.2% decline in sales

came from its own operations, compared

volumes. The decrease was attributable to

External revenues from flat-rolled products

with 63.2% in 2020.

change in product mix and a reduction in

surged by 62.3% YoY, driven by a 70.5%

the output following the introduction of

upswing in sales prices.

Steel segment revenues from sales

the export duty in 2021. The primary factor

of vanadium products, including

was a surge of 90.0% in the average prices

Revenues from external steel product sales

intersegment sales, climbed by 47.6%, due

of slabs.

in Russia climbed by 43.9% YoY, primarily

primarily to a 38.8% increase in sales prices.

because of higher prices and greater

Vanadium product prices followed market

Revenues from sales of construction products

demand. The share of the Russian market

trends, including the London Metal Bulletin

to third parties jumped by 57.8% YoY amid

in total external steel product sales decreased

and Ryan’s Notes benchmarks.

an increase of 58.8% in average prices. This

from 48.7% in 2020 to 48.2% in 2021. Asia’s

1. Includes billets, slabs, pig iron, pipe blanks and other semi-finished products

was caused mainly by higher sales prices

share of sales fell from 36.2% to 29.7%

2. Includes rebars, wire rods, wire, beams, channels and angles

for rebars on the Russian and CIS markets,

because of lower sales volumes for billets.

3. Includes rails, wheels, tyres and other railway products

4. Includes commodity plate and other flat-rolled products

42

5. Includes rounds, grinding balls, mine uprights and strips, and tubular products

43

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

Steel segment cost of revenues

Steel, North America segment

Steel segment cost of revenues

Sales review

2021

2020

Steel, North America segment revenues by product

US$ MILLION

% OF SEGMENT

US$ MILLION

% OF SEGMENT

CHANGE, %

REVENUES

REVENUES

2021

2020

Cost of revenues

6,070

59.7

4,596

65.9

32.1

US$ MILLION

% OF TOTAL

US$ MILLION

% OF TOTAL

CHANGE, %

Raw materials

3,150

30.9

2,025

29.1

55.5

SEGMENT

SEGMENT

REVENUES

REVENUES

Iron ore

776

7.6

503

7.2

54.3

Steel products

2,227

95.8

1,684

94.7

32.2

Coking coal

1,218

12.0

769

11.0

58.4

Semi-finished products2

10

0.4

109

6.1

(90.8)

Scrap

673

6.6

442

6.3

52.3

Construction products3

268

11.5

183

10.3

46.4

Other raw materials

483

4.7

311

4.5

55.3

Railway products4

392

16.9

326

18.3

20.2

Auxiliary materials

328

3.2

339

4.9

3.2

Flat-rolled products5

900

38.7

323

18.2

178.6

Services

266

2.6

241

3.5

10.4

Tubular and other steel products6

657

28.3

743

41.8

(11.6)

Transportation

380

3.7

407

5.8

(6.6)

Other revenues7

97

4.2

95

5.6

2.1

Staff costs

518

5.1

477

6.8

8.6

TOTAL

2,324

100.0

1,779

100.0

30.6

Depreciation

256

2.5

233

3.3

9.9

Energy

416

4.1

398

5.7

4.5

Other1

756

7.4

476

6.8

58.8

Sales volumes of Steel, North America segment, thousand tonnes

2021

2020

CHANGE, %

In 2021, the Steel segment’s cost of

Transportation costs dropped by 6.6%,

Steel segment gross profit

•

revenues increased by 32.1% YoY. The main

primarily because of lower railway tariffs.

Steel products

reasons for the growth in costs were as

•

Depreciation costs increased by 9.9%,

The Steel segment’s gross profit surged

Semi-finished products

-

144

(100.0)

follows:

mainly because of higher depreciation

by 73.5% YoY and amounted to US$4,118

Construction products

268

262

2.3

The cost of raw materials rose by 55.5%,

at EVRAZ NTMK after fixed assets were

million in the reporting period driven

•

Railway products

383

404

(5.2)

primarily because of the higher cost

upgraded to improve their technical

primarily by higher prices for semi-finished,

of coking coal (up 58.4%) and iron ore

condition.

construction and vanadium products. This

Flat-rolled products

625

382

63.6

(54.3%) amid price increases. Scrap costs

•

Other costs jumped by 58.8%, largely

was partly offset by the negative effect

Tubular and other steel products

402

537

(25.1)

climbed by 52.3% because of higher

because of increase in taxes due to

of higher costs.

TOTAL

1,678

1,729

(2.9)

prices for scrap, which was driven by

export duty on metal products effective

global market trends.

from 1 August 2021 and lower cost of

•

Service costs rose by 10.4%, primarily

goods for resale amid an increase in

driven by higher costs for processing

purchase prices in 2021 compared with

The Steel, North America segment’s

Revenues from construction product

improvement and a 115.0% increase in sales

costs of vanadium in slag.

2020.

revenues from the sale of steel products

sales rose by 46.4% YoY because

prices as a result of higher third-party

climbed by 32.2% YoY amid a 35.3% surge

of a 2.3% increase in volumes and a 44.1%

demand in 2021 amid the rapid market

in sales prices, offset by a 2.9% decrease

improvement in prices. The upward trend

recovery from the pandemic and limited

in sales volumes. The reduction in volumes

was driven by greater market demand amid

supply.

was mainly attributable to sales of tubular

the economic recovery.

and semi finished products, which was

Revenues from tubular and other steel

partly compensated by increased sales of

Railway product revenues increased

product sales fell by 11.6% YoY due to a

flat-rolled and construction products.

by 20.2%, driven by a growth in sales

25.1% drop in sales volumes, which was

prices of 25.4%. This was partly offset

partly offset by an 13.5% uptick in sales

Revenues from semi-finished product

by a decrease in sales volumes of 5.2%.

prices. The reduction in volumes was

sales dropped to almost zero following

caused by the idling of the spiral mills

the fulfilment of a contract with a key

Revenues from flat-rolled products soared

following the completion of 2020 orders.

customer in 2020.

by 178.6% amid a 63.6% jump in volumes.

This was supported by rapid market

2. Includes slabs

3. Includes beams and rebars

4. Includes rails and wheels

5. Includes commodity plate, specialty plate and other flat-rolled products

6. Includes large-diameter line pipes, ERW line pipes, seamless and welded OCTG and other steel products

1. Primarily includes goods for resale, intersegment unrealised profit and certain taxes, semi-finished products and allowances for inventories

44

7. Includes scrap and services

45

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

Steel, North America segment cost of revenues

Sales volumes of Coal segment, thousand tonnes

2021

2020

CHANGE, %

Steel, North America segment cost of revenues

External sales

2021

2020

Coal products

10,608

12,336

(14.0)

US$ MILLION

% OF SEGMENT

US$ MILLION

% OF SEGMENT

CHANGE, %

Coking coal

686

2,233

(69.3)

REVENUES

REVENUES

Coal concentrate and other products

9,922

10,066

(1.4)

Cost of revenues

1,835

79.0

1,604

90.1

14.4

Steam coal

37

n/a

Raw materials

888

38.2

454

25.5

95.6

Intersegment sales

Semi-finished products

137

5.9

238

13.4

(42.4)

Auxiliary materials

202

8.7

172

9.7

17.4

Coal products

6,197

6,986

(11.3)

Services

135

5.8

145

8.2

(6.9)

Coking coal

2,172

2,323

(6.5)

Staff costs

240

10.3

240

13.5

-

Coal concentrate

4,025

4,663

(13.7)

Depreciation

89

3.8

100

5.6

(11.0)

TOTAL, COAL PRODUCTS

16,805

19,322

(13.0)

Energy

119

5.1

90

5.1

32.2

Other1

25

1.1

165

9.3

(84.8)

In 2021, the Coal segment’s overall revenues

was partly offset by an 14.0% decrease in sales

by an 11.3% drop in sales volumes amid

increased as sales prices rose in line

volumes because of lower production of the

a shortage of premium K-grade coal.

In 2021, the Steel, North America segment’s

Auxiliary material costs rose by 17.4%

higher production and prices, which

with global market trends. As the global

GZh grade and a change in the product mix

•

cost of revenues increased by 14.4% YoY.

following a change in classification (lime

were driven by global market trends.

market recovered from the pandemic-

in favour of coking coal concentrate to meet

In 2021, the Coal segment’s sales to the Steel

The main drivers were as follows:

and coke to auxiliary materials, which

related decline seen in 2020, demand

customer needs. Revenues from external sales

segment amounted to US$762 million (32.8%

were previously included in other raw

for coal grew. Production restrictions

of coking coal and coking coal concentrate

of total sales), compared with US$536 million

•Raw material costs surged by 95.6%,

which was primarily attributable to the

materials).

Steel, North America segment

observed since the second half of 2021 in key

climbed by 28.4% and 68.3%, respectively,

(35.9%) in 2020.

higher cost of scrap metal and increased

Service costs fell by 6.9%, mainly driven

gross profit

global producing regions also contributed

amid higher prices.

•

consumption due to transition to increased

by decline in coating services due to

to the strong increase in international prices.

During the reporting period, roughly

share of internal supply of semi-finished

decreased pipe sales volumes.

The Steel, North America segment’s gross profit

Revenues from internal sales of coal products

70.7% of EVRAZ’ coking coal consumption

products.

Energy costs rose by 32.2%, primarily

totalled US$489 million in the reporting period,

Revenues from external sales of coal products

surged by 42.2%, mainly because of a 53.5%

in steelmaking came from the Group’s own

•

•The cost of semi-finished products

because of higher natural gas prices.

up from US$175 million in 2020. The increase

increased amid a 78.8% upswing in prices. This

jump in sales prices, which was partly offset

operations, compared with 78.0% in 2020.

dropped by 42.4% driven by a reduction

Other costs were down for the reporting

was primarily driven by a significant growth

•

of externally purchased materials and

period, mainly because of changes

in revenues amid favourable market conditions.

transition to internal supply.

in balances of finished goods and work

It was partly offset by higher prices for raw

Coal segment cost of revenues

in progress compared with 2020 amid

materials, auxiliary materials and energy.

Coal segment cost of revenues

2021

2020

Coal segment

US$ MILLION

% OF SEGMENT

US$ MILLION

% OF SEGMENT

CHANGE, %

Sales review

REVENUES

REVENUES

Cost of revenues

919

39.6

1,027

68.9

(10.5)

Coal segment revenues by product

Auxiliary materials

141

6.1

110

7.4

28.2

Services

65

2.8

53

3.5

22.6

2021

2020

Transportation

286

12.3

294

19.7

(2.7)

US$ MILLION

% OF TOTAL

US$ MILLION

% OF TOTAL

CHANGE, %

Staff costs

226

9.7

200

13.4

13.0

SEGMENT REVENUES

SEGMENT REVENUES

Depreciation

164

7.1

163

10.9

0.6

External sales

Energy

46

2.0

43

2.9

7.0

Coal products

1,531

65.9

929

62.4

64.8

Other1

(9)

(0.4)

164

11.0

(105.5)

Coking coal

95

4.1

74

4.9

28.4

Coal concentrate

1,436

61.9

853

57.3

68.3

The volume of total coal products sales

Osinnikovskaya, Erunakovskaya

and resumption of work at Razrez

Steam coal

-

-

2

0.2

(100)

decreased by 13% and caused decrease

and Raspadskaya mines.

Raspadsky.

of cost of sales by 10.5% while cost

Intersegment sales

•Costs for services climbed by 22.6%

of production increased due to increase

due to the high growth of the prices

Coal products

762

32.8

536

35.9

42.2

of production as well as the following

of contractors services in Kuzbass

Coal segment gross profit

Coking coal

184

7.9

101

6.8

82.2

factors:

region.

Coal concentrate

578

24.9

435

29.2

32.9

In 2021, the Coal segment’s gross profit

•The cost of auxiliary materials rose

•Staff costs were up because of higher

Other segment revenues

28

1.2

25

1.7

12.0

by 28.2% amid higher longwall

mining volumes accompanied

amounted to US$1,402 million, up from

move costs at the Alardinskaya,

with insourcing new equipment

US$463 million a year earlier, primarily

TOTAL

2,321

100

1,490

100.0

55.8

because of the surge in sales prices.

46

1. Primarily includes transportation, goods for resale, certain taxes, changes in work in progress and fixed goods and allowances for inventories

47

1. Primarily includes goods for resale, certain taxes, changes in work in progress and finished goods, allowance for inventory, raw materials and intersegment unrealised

profit

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

BUSINESS

Production highlights

Crude steel

Iron ore products

REVIEW

11,690 kt

14,399 kt

Steel products

Vanadium slag

STEEL SEGMENT

10,763 kt

20,058 mtV

EVRAZ is the leader in the long

2

Sales highlights

RUSSIA

products and rail segments in Russia

and is the world’s largest producer

Finished products

Iron ore products

of vanadium, with a global market

EVRAZ

6,056 kt

1,430 kt

share of 14%. The Steel segment’s

KGOK

EVRAZ

Semi-finished products

Vanadium final products

primary focus is producing steel in

NTMK

the CIS from nearby raw materials

EVRAZ

5,541 kt

13,288 mtV

Moscow

ZSMK

to serve regional infrastructure

EVRAZ

Vanady Tula

EVRAZ

and construction sectors, while

Financial highlights

Caspian Steel

EVRAZ

maintaining export flexibility. We

Nikom

CZECH

Revenues

EBITDA margin

KAZAKHSTAN

are in the first quartile of the

REPUBLIC

US$10,188 m

35.4 %

global crude steel cost curve.

EBITDA

CAPEX

US$3,609 m

US$468 m

Mining operations

Steelmaking operations

Vanadium operations

Trading companies

EVRAZ KGOK, Russia

EVRAZ ZSMK, Russia

EVRAZ NTMK, Russia

EVRAZ Vanady Tula, Russia

EVRAZ Market

EVRAZ East Metals

EVRAZ KGOK is the Group’s core mining

The largest steel producer in Siberia, EVRAZ

EVRAZ NTMK is one of the largest

EVRAZ Vanady Tula is the largest European

EVRAZ Market is a leading Russian

A Switzerland-based trading company,

asset. It is located in Urals, 140 kilometres

ZSMK is located in the city of Novokuznetsk

integrated steel production plants in

producer of vanadium pentoxide,

provider of steel for infrastructure projects

East Metals AG is EVRAZ’ sole distribution

from the primary consumer of its products,

in Kemerovo region (Kuzbass). It has five

Russia and has a full processing cycle. It

ferrovanadium-50 and ferrovanadium-80,

and a trader supplying rebar, profile, flat,

channel outside the CIS. Its main exports

EVRAZ NTMK. EVRAZ KGOK mines

coke oven batteries and three blast furnaces

is located in the city of Nizhniy Tagil in

which are alloy additions used to

tubular and rolled steel from major plants

include semi-finished steel products

titanomagnetite iron ore, which contains

in operation. For steelmaking, it has two

the Ural region. It has coke and chemical

manufacture extra-high-strength steel for

in the CIS. Its major presence in various

(slab and square billet), long finished

vanadium, meaning that it can be used to

oxygen converter shops, which have five

production facilities, two blast furnaces,

various applications and titanium alloys.

regions of Russia is supported by a branch

products (rail, beam, wire rod and rebar),

produce high-strength grades of alloy steel.

basic oxygen furnaces, and an electric arc

steelmaking units (one oxygen converter

It is located in Tula, 180 kilometres from

network that includes 48 subdivisions,

pig iron, coking coal, vanadium products

EVRAZ KGOK mines ore from three open

furnace (EAF). EVRAZ ZSMK operates one

shop consisting of four LD converters),

Moscow. The site’s production and scientific

and its branches are located in industrial

and iron ore pellets. It has a wide

pits and then processes it in its crushing,

eight-strand continuous casting machine,

four continuous casters, seven rolling

resources make it possible to process

centres across the country, as well as

network of agencies and representative

processing, sintering and pelletising plants.

which produces square billets; a two-strand

mills, and a heat and power generation

any vanadium-containing materials into a

in Kazakhstan. Each subdivision’s product

offices (including in China, Hong Kong,

The final product, in the form of sinter and

continuous slab casting machine; and one

plant.

wide range of products. EVRAZ Vanady

range is tailored to local demand. In

Indonesia, Japan, the Philippines, South

pellets, is shipped by railcar to consumers,

four-strand continuous casting machine,

Tula uses low-cost, efficient technology to

addition, it has a pool of 120 metal

Korea, Taiwan, Thailand and Turkey),

including those abroad.

which makes semi-finished products for

process vanadium slag from EVRAZ NTMK.

processing machines, which enables it to

which ensures proximity to clients in key

EVRAZ Caspian Steel,

markets.

the rail mill. Rolling facilities include a

offer HVA products.

Kazakhstan

blooming mill, one medium-section 450

EVRAZ ZSMK mining

EVRAZ Nikom, Czech

mill, two small-section 250 mills, one rail

EVRAZ Caspian Steel is located in

operations1, Russia

and structural steel mill, one sectional mill

Republic

Trading Company EVRAZ

Kostanay, Kazakhstan. It has a light-

and two ball-rolling mills. The steel mill has

EVRAZ ZSMK include several mining and

section rolling mill.

Located 30 kilometres from Prague,

Trading Company EVRAZ is Russia’s

its own coal washing plant for coking coal

processing facilities in Siberia. Most of

EVRAZ Nikom produces ferroalloys

largest supplier of rolled steel and sells

and can also produce customised coking

the iron ore that it produces is consumed

and corundum material. It converts

EVRAZ products domestically and in

coal blends.

internally by its steelmaking operations.

the vanadium oxide produced by EVRAZ

the CIS. It focuses on products for the

It conducts underground mining, and its

Vanady Tula into ferrovanadium,

construction, engineering, transportation

mining complex includes three mines, a

the major vanadium product used

(rails, wheels and specialist products),

limestone quarry, and a concentration and

by the steel industry to increase strength

mining and pipe-making sectors.

48

sinter plant.

and hardness.

49

1. Former Evrazruda

2. Sales to third parties only.

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

Production highlights

STEEL, NORTH AMERICA

Crude steel

Steel products

SEGMENT

1,879 kt

1,655 kt

EVRAZ is a leading North

Sales highlights1

CANADA

American producer of high-

quality, engineered steel for

Steel products

rail, energy and industrial end-

EVRAZ

1,678 kt

EVRAZ

user markets. The segment is the

Red Deer

Camrose

largest producer of rail and large-

EVRAZ

EVRAZ

Financial highlights

Calgary

diameter pipe (LDP) in North

Regina

America. Its operations also lead

Revenues

EBITDA margin

EVRAZ

in Western Canada’s oil country

US$2,324 m

13.8 %

Portland

tubular goods (OCTG) and small-

Chicago

EBITDA

CAPEX

diameter line pipe (SDP) markets,

USA

US$ 321 m

US$ 216 m

as well as in the US West Coast

EVRAZ

Pueblo

plate market.

Steelmaking and rolling - Canada

Steelmaking and rolling - USA

Recycling

EVRAZ Regina

EVRAZ Calgary

EVRAZ Red Deer

EVRAZ Portland

EVRAZ Pueblo

EVRAZ Recycling

Located in Saskatchewan, EVRAZ Regina is

EVRAZ Calgary has an ERW pipe mill and

EVRAZ Red Deer has an ERW pipe mill

EVRAZ Portland in Oregon has a Steckel

EVRAZ Pueblo in Colorado has three

EVRAZ Recycling is the largest metal

the largest steelmaker in Western Canada.

heat treatment, API threading and finishing

producing OCTG casing and SDP with an

rolling mill, a plate quench and tempering

rolling mills: a rail mill; a seamless pipe

scrap recycler in Western Canada, with

It operates two EAFs, a ladle furnace and

lines for OCTG casing with an external

outside diameter of up to 13 3/8 inches.

facility, and two HSAW pipe mills. The

mill that produces OCTG products for use

13 facilities across the prairies, as well as

a continuous variable-width slab caster,

diameter of up to 9 5/8 inches. The site

The site includes a casing heat treatment

rolling facility is the only plate mill on the

in oil and gas production; and a wire rod

three facilities in the US, located in North

and a Steckel mill capable of rolling coil

also operates ERW tubing finishing facilities

line, API and premium threading lines, and

West Coast and has deep-water access

and coiled reinforcing bar mill. It also

Dakota and Colorado. EVRAZ Recycling

and plate with a width of up to 72 inches.

comprising pipe upsetting, threading, testing

separate OCTG casing and SDP finishing

to the Pacific Ocean, as well as access to

operates one EAF and a billet caster that

buys, processes and sells a wide range

EVRAZ Regina produces carbon steel slabs,

and inspection. EVRAZ Calgary’s products

line.

Class I railways and trucking routes serving

supplies round billets to the hot rolling

of ferrous and nonferrous materials, while

flat-rolled discrete plate and coiled plate.

are primarily used in oil and gas exploration

North America. Finished products include

mills. In addition, EVRAZ Pueblo owns

also offering a variety of metal recycling

Its tubular operations consist of a 24-inch

and production in Canada and the US.

hot-rolled carbon and alloy steel plate, hot-

and operates the Colorado and Wyoming

and other services, including auto

EVRAZ Edmonton Coupling

Electric Resistance Welded (ERW) line pipe

rolled coil, heat-treated plate, shot-blasted

railway. This short-line route serves

wrecking yards that provide low-cost parts

mill, a 2-inch ERW pipe mill (for OCTG

Machining

and primed plate, temper-passed cut-to-

the Group’s mills and connects the site

on a self-serve basis.

welding), five helical submerged arc-welded

EVRAZ Camrose

length plate and plate coil.

to both the Burlington Northern Santa Fe

EVRAZ Edmonton Coupling Machining

(HSAW) mills and an ID/OD coating facility,

and the Union Pacific railway lines, thereby

EVRAZ Camrose operates an ERW pipe mill

specialises in manufacturing API couplings

which produces LDP for oil, natural gas and

reducing delivery costs to these customers.

and a finishing line, capable of producing

with an outside diameter of up to 9 5/8

LNG transportation. EVRAZ Regina’s tubular

SDP and carbon OCTG casing with an

inches. Couplings produced at ECM are

mills are important suppliers to the North

external diameter of up to 16 inches. Its

supplied to EVRAZ’s Calgary and Red

American energy markets, serving leading

products are primarily used in oil and natural

Deer OCTG casing and tubing operations.

energy producers and midstream operators

gas drilling, transportation and distribution,

in both Canada and the US.

as well as in the transportation of other

substances such as carbon dioxide.

50

1. Sales to third parties only

51

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

Production highlights

COAL SEGMENT

Raw coking coal

Coking coal concentrate

RUSSIA

23,272 kt

14,448 kt

Raspadskaya is one of the leading

coal producers in Russia in terms

Sales highlights1

of both volume and cash costs.

It also has a diverse product

Raw coking coal

Coking coal concentrate

portfolio and diversified client

Yuzhkuzbassugol

Raspadskaya

686 kt

9,922 kt

base.

Mezhegeyugol

Financial highlights

Revenues

EBITDA margin

US$2,321 m

55.7 %

EBITDA

CAPEX

US$1,292 m

US$228 m

Mining and coal washing operations

Raspadskaya consolidates EVRAZ’ Russian coal assets, which are located in the Kemerovo region and the Republic of Tuva (Russia).

Mezhdurechensk site

Novokuznetsk site

Mezhegey

Raspadskaya has two operational

Raspadskaya has five coking coal mines

In the beginning of 2020, the decision

underground coking coal mines and two

in Novokuznetsk. They produce hard

was made to halt production

open pits in Mezhdurechensk, including

and semi-hard coking coal (Zh, GZh

at the Mezhegey mine. Subsequently,

the Raspadskaya mine, Russia’s largest.

and KS grades), which is processed

in December 2021 the decision was made

The site produces hard coking coal

into high-quality concentrate (classified

to resume mining operations in 2022.

(K and OS grades), semi-hard coking

as HCC grade internationally). Most of this

coal (GZh grade) and semi-soft coking

comes from the Yerunakovskaya-8 mine.

coal (GZhO grade). Its coal washing plant

At the Novokuznetsk site, Raspadskaya

is one of the most modern in Russia. It has

has two coal washing plants, which

low maintenance costs and is designed

produce customised coking coal blends

to process high volumes with few

and pulverised coal injection (PCI)

employees.

coal. The Kuznetskaya washing plant

produces high-quality HCC concentrate

for the domestic market. The Abashevskaya

washing plant produces a wide variety

of products tailored to specific customers’

needs.

52

1. Sales to third parties only

53

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

SUSTAINABILITY

Sustainability governance

In December 2021, the Board

SUSTAINABILITY MANAGEMENT

of Directors of EVRAZ established

the Sustainability Committee -

an expansion of the previous Health,

ESG highlights, Steel segment

Safety and Environment Committee -

to drive the Group’s sustainability agenda.

Prior to that, in August 2021, we created

a separate sustainability-focused body

Lost-time injury frequency rate1, X

Key air emissions1, kt

GHG intensity ratio1, tCO2/tcs

Our approach

at the management level to supervise

and monitor the performance of corporate

At EVRAZ, we believe that sustainable development

functions in this area. Read more

plays a vital role in our success. To maintain focus

on pages 58-60 in the Health and safety,

0.74x

105.43

kt

1.90

on this important area, we have made ESG one

and environment section.

2021

0.74x

of the key bases of our business.

2021

105.43

2021

1.90

2020

0.85x

EVRAZ has internal corporate documents

2020

116.47

2020

1.95

2019

122.46

2019

1.94

Steel is a crucial material in the transition towards

in place governing its activities in the area

a circular, low-carbon economy. We recognise

of sustainability and requires strict compliance

Read more on

page 61

Read more on

page 68

Read more on page 62

our responsibility to produce it in a way that

throughout the business. We regularly

minimises the impact on the environment while

review and update both the requirements

Fatalities1, number of people

Wastewater discharges1, million m3

Non-mining waste recycling

responding to the needs of our stakeholders. We

and the documents themselves to ensure that

or re-use rate1, %

are looking at more than just our carbon footprint.

they remain aligned with our sustainability

We want to address all the ways in which we

agenda. The following are the most important

can improve on how we use the world's natural

documents for the Group:

6

74.32

105.4

resources, maintain close ties with our employees,

•Code of Business Conduct.

communities, and other stakeholders, and align our

2021

2021

2021

•Supplier Code of Conduct.

6

63.48

10.84

74.32

105.4

business with sustainable shareholder returns.

2020

1

2020

68.58

12.47

81.05

2020

103.1

•Health, Safety and Environmental Policy.

2019

7

2019 68.90

12.86

81.76

2019

105.6

•Social Investments Guidelines.

We aim to navigate sustainable development

Steel

•Anti-Corruption Policy.

challenges in current and future operations

Mining - Ore

•Hotline Policy.

and business processes across the Group

Read more on

page 61

Read more on page 69

Read more on

page 70

•Policy on Main Procurement Principles.

by focusing on:

•Human Rights Policy.

•Combatting climate change: mitigating climate

•Diversity and Inclusion Policy.

risks and reducing GHG emissions to contribute

•Modern Slavery Statement.

to urgent action against climate change impacts.

Environmental protection: taking responsibility

•

for preserving the natural environment

Best practices and standards

in the regions of our presence.

•

Employee wellbeing: providing safe working

EVRAZ strives to adhere to international

conditions, extensive learning and development

standards across its operations. We

opportunities, and competitive compensation

have been a participant in the UN

packages.

Global Compact initiative since 2020.

Diversity: promoting equal opportunities and zero

Consistent with the Group’s commitment

•

tolerance of discrimination of any kind.

to transparency, we make comprehensive

Local community development: supporting

ESG disclosures in our annual

•

the sustainable social and economic development

and sustainability reports and published our

of the regions in which we operate.

first climate change report in 2020. We align

our reporting with the recommendations of

international standards-setting organisations,

such as the Global Reporting Initiative (GRI)

and Sustainability Accounting Standards

Board (SASB).

54

1. Data on this indicator does not include EVRAZ coal segment.

55

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

The Group’s Environmental Strategy 2030

and processes, but also into those

•Undertaking investments

EVRAZ fully supports the UN Sustainable Development Goals (SDGs), which the UN General Assembly

names GHG emissions management as

of the Group’s broader network of partners.

and operational measures aimed

approved in 2015. We make substantial efforts to contribute to the achievement of all SDGs, including by

one of a key activity. EVRAZ sets GHG

EVRAZ encourages potential partners

at improving energy efficiency,

providing quality employee benefits, promoting green technologies and encouraging the implementation

emissions targets within this strategy

to adhere to our sustainability values

developing internal power generation

of sustainability projects, among other initiatives. As part of our ESG agenda, we focus our efforts on

and discloses the methodologies used

by developing standards for suppliers.

capacity, using renewable energy

contributing to the following six priority SDGs:

to calculate them to better comply with

To evaluate suppliers, we conduct field

sources and upgrading equipment.

international requirements.

inspections and audits and collect

feedback from supplier representatives.

Environmental management

Read more on pages 62-66 in the Climate change

Our Procurement Commission verifies

•Continuing to implement waste

and GHG emissions section

information included in forms filled

management, water conservation

by representatives regarding their

and emissions reduction projects.

Stakeholder engagement

commitment to a responsible approach

•Implementing our biodiversity roadmap.

to HSE issues throughout the assessment

We ensure healthy lives and promote

Our core values include environmental protection,

We are closely engaged with our

phase for prospective suppliers. Non-

Our people

wellbeing for all.

including water resource management and biodiversity loss

stakeholders and recognise their rising

compliance with HSE requirements is one

•Revising our human resources strategy.

Read more pages 58-70 in the Health, safety and

prevention.

expectations, especially regarding

of the reasons EVRAZ would reject

environment section

Read more pages 67-70 in the Environmental management section

•Implementing a supportive learning

decarbonising our operations in alignment

a partnership. The Group strives to establish

structure for production managers

with the Paris Agreement, adhering

favourable circumstances for the socio-

aimed at developing new skills

to sustainability standards across the supply

economic growth of the regions in which it

for external change management.

chain, protecting the health and wellbeing

operates and collaborates actively with local

•Developing a long-term planning

of our employees and local communities,

suppliers.

programme to forecast our needs

and promoting diversity.

as an employer and enhance

the channels that we use to attract new

The Group’s key stakeholders

workers.

are employees, investors and shareholders,

Mid-term outlook

customers, suppliers and contractors, local

Community relations

We prioritise energy efficiency and

We promote diversity and inclusion and do not tolerate

communities, regulatory bodies, the media

EVRAZ aims to continuously improve its

Improving partnerships with local

•

combating climate change.

discrimination in any form.

and industry organisations. We strive

sustainability management practices. Our

communities in a variety of ways,

Read more pages 62-66 in the Climate change

Read more pages 71-73 in the Our people section

to deliver value to all our stakeholders

nearest and mid-term plans include major

including upgrading urban

and GHG emissions section

and improve engagement strategies

projects in the following areas:

infrastructure, financing sport events,

regularly. Our stakeholder engagement

and implementing educational

includes a wide range of interactive tools

Health and safety

and social projects.

and mechanisms. We rely on transparency

•Revising the operational model

and open communication when reaching

for safety management at our

We also strive to contribute

Canadian Chamber of Commerce.

The climate-related disclosure is discussed

out to our stakeholders and intend to do so

production to standardise and specify

•

to the achievement of the SDGs

Saskatchewan Chamber of Commerce.

in Task Force on Climate-related Financial

in future.

all the innovations implemented

•

through our membership in key industry

Canadian Manufacturers and Exporters

Disclosures (TCFD) compliance statement.

in the Company for 2020-2021.

•

and business associations and our

organisation.

collaboration with various institutes. In 2021,

•

Canadian Steel Producers Association.

see page ХХ

Responsible supply chain

Climate change and GHG emissions

EVRAZ was a member of the following

American Iron and Steel Institute.

management

•

•Calculation of Scope 3 GHG emissions.

organisations:

Donors Forum.

•

•Carrying out a quantitative assessment

Russian Managers Association.

Association of American Railroads.

The Group determines relevant climate-

Our approach to engaging suppliers

of climate-related risks.

•

•

related risks for the short, medium and long

is regulated by EVRAZ Policy on Main

•Russian Union of Industrialists

•Continuing to develop a climate strategy.

and Entrepreneurs.

term in line with TCFD recommendations.

Procurement Principles and the Supplier

•Updating accounting and monitoring

TCFD disclosure

Risks are categorized as transition or physical.

Code of Conduct. We are dedicated

practices for energy consumption.

•Association of Industrialists of Mining

and Metals Production Sector of Russia.

EVRAZ has evaluated climate-related risks

to integrating sustainability concepts

Disclosure of information regarding climate

and ranked them by importance.

into not just our internal operations

•World Steel Association.

change follows TCFD recommendations

•Russian Steel Association.

•

Non-Commercial Partnership National

and is broken down according to several

Read more on pages 92-96

Association for Subsoil Use Auditing.

categories: governance, strategy, risk

American Railway Engineering

management, and metrics and targets.

In 2022, the Group intends to carry out

•

and Maintenance-of-Way Association.

The Board of Directors oversees matters

a quantitative assessment of climate-

related to climate change, including

related risks. These risks are integrated

•Consumer Council on Operations

of OJSC Russian Railways.

by setting GHG emissions targets,

into the corporate risk management system,

as well as by assessing and managing

and EVRAZ has a strategy for mitigating

•Steel Construction Development

Association.

transition and physical climate risks. Climate

them.

is also within the remit of the Sustainability

•Russian Union of Metal and Steel

Suppliers.

Committee.

Read more on pages 84-96

56

in the Principal risks section

57

Meet EVRAZ

EVRAZ in figures

STRATEGIC REPORT

Corporate governance

Financial statements

Additional information

ANNUAL REPORT & ACCOUNTS 2021

including our line and senior management.

such as the World Steel Association’s Safety

The Company operates in accordance

HEALTH, SAFETY AND ENVIRONMENT

To bolster our HSE management systems

and Health Committee, as well as the HSE

with technical regulations,

and foster a safety culture, in 2021, EVRAZ

committees of Russian Steel (a Russia-

as well as the following documents governing

established two governing bodies within its

based non-commercial partnership)

labour protection:

Our approach

The Group adheres to international best

facilities to certify them under ISO 45001

organisational structure.

and the Russian Union of Industrialists

•HSE Policy.

practices in HSE. While international

as the validity period of OHSAS 18001

and Entrepreneurs. We evaluate

•Cardinal Safety Rules.

certification of the HSE management

expires.

In December 2021, the Board

and formulate proposals on various

•Fundamental Environmental Requirements.

HSE management systems

systems is not a legal requirement, most

of Directors transformed HSE Committee

legislative initiatives and work to develop

•Standard Incident Reporting Rules.

EVRAZ facilities are certified as compliant

The Group recognises that the engagement

into the Sustainability Committee. It

a common position among the associations’

Preserving the life and health of employees

with the requirements of the OHSAS 18001/

of senior executives in the HSE

plays a key role in managing HSE issues

members.

In 2021, the number of corporate HSE

and protecting the environment during

ISO 45001 occupational health and safety

management process is a crucial element

at the Board level and is responsible

documents was revised and amended.

our daily operations is an absolute priority

management and ISO 14001 environmental

in the plan to enhance the effectiveness

for setting the Company’s strategy in this

Some changes were made to the Standard

for EVRAZ. The Company operates

management standards. EVRAZ is currently

and improve the functionality of its

area.

HSE documents

Incident Reporting Rules. The Cardinal

HSE management systems to mitigate

aligning the occupational health and safety

HSE management systems. HSE issues

Safety Rules were also updated and a new

the associated risks in its operations.

management system for relevant

are considered at every corporate level,

In August 2021, EVRAZ established

The EVRAZ HSE Policy is the fundamental

lockout, tagout (LOTO) procedure

a Sustainability Management Committee

document regulating issues

was added that prohibits working without

at the executive level. The Group’s corporate

of environmental matters, including climate

applying safety locks.

strategy and performance management vice

change, issues related to biodiversity,

HSE GOVERNANCE STRUCTURE

president chairs the committee and the CEO

occupational health and safety

and heads of business units regularly attend

and the involvement of contractors in safety

Climate risk governance

its meetings. The committee’s tasks include

processes. The policy formalises the basic

BOARD OF DIRECTORS

driving improvements in the safety culture

principles that the Group has set for itself,

Issues related to climate change are handled

by setting and revising relevant goals

as well as the commitments that have been

by the Board of Directors and are considered

and approving annual KPIs for line managers.

made. The Company's policy is regularly

at regular Board and Sustainability Committee

At the level of the Group’s enterprises, local

reviewed, the last changes were made

meetings.

AUDIT COMMITTEE

CEO

SUSTAINABILITY COMMITTEE

HSE departments supervise HSE issues.

to it in 2021. EVRAZ strives to comply

with all requirements of labour protection

At the executive level, the Sustainability

EVRAZ actively engages with industry

legislation and internal Company rules.

Management Committee also considers issues

SUSTAINABILITY MANAGEMENT COMMITTEE

associations on matters related

related to climate change and decarbonisation.

to occupational health and industrial safety,

CORPORATE STRATEGY

TECHNOLOGIES

RISK MANAGEMENT

AND PERFORMANCE

DEVELOPMENT VICE

HSE VICE PRESIDENT

WORKING GROUP

MANAGEMENT VICE

PRESIDENT

PRESIDENT

ENERGY AND CLIMATE

ENVIRONMENTAL

HEALTH AND SAFETY

INDUSTRIAL SAFETY

MANAGEMENT

MANAGEMENT

DIRECTOR

DIRECTOR

DIRECTOR1

DIRECTOR

HSE REPRESENTATIVES AT ALL EVRAZ OPERATIONS

1. Appointed in January 2022

58

59

содержание .. 1 2 3 4 ..